Judson Mill

JUDSON MILL

Greenville, SC

TEAM MEMBERS WHO WORKED ON THIS PROJECT:

“The financial benefit to the project from the NMTC allocation not only helped the project’s overall feasibility, but it allowed us to offer commercial space to several local and non-profit tenants at significantly reduced rental rates which helped us bring in the right tenant mix for this historic neighborhood.”

Thomas F. Taft, Jr.

Principal of Taft Family Ventures

PROJECT HIGHLIGHTS:

TOTAL PROJECT COST:

$18,900,000

NMTC ALLOCATION:

$16,500,00

FINANCING COMPLETE:

September 2020

PROJECT SPONSOR:

Taft Family Ventures and Belmont Sayre Holdings

CDE:

The Innovate Fund, LLC

NMTC INVESTOR:

Truist Community Capital

LEVERAGED LENDER:

Judson Mill Lev Lend II, LLC

ADDRESS:

701 Easley Bridge RoadGreenville, SC

CENSUS TRACT:

45045002105

COMMUNITY OUTCOMES:

107,269 SF

197 Direct Jobs

51.48% Below-Market Reduced Rent

LOW-INCOME COMMUNITY:

Poverty Rate: 44.20%

Median Family Income: 36.80%

ARC Distressed Area

HFFI Food Desert

Brownfield

FEMA Disaster Area

State/Local Economic Zone

MORE INFORMATION:

Click here www.judsonmilldistrict.com

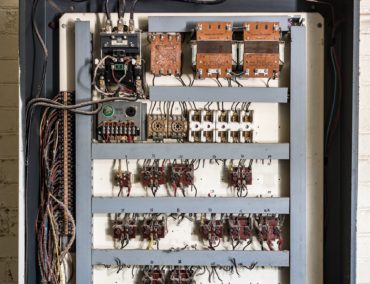

Westervelt Mill opened in 1912 as the first fine goods textile mill in the South. The name only lasted one year before it was changed to Judson Mill, after the mill president’s mentor, D. Charles Judson. Deering Milliken Co. (now Milliken & Company) bought the mill in 1960 and actively operated and expanded the mill into an eventual 800,000 square foot campus comprised of 6 distinct buildings. The mill ceased operations in 2015 as one of the last two operational mills in Greenville – closing with only 200 employees, a substantially lesser number than the thousands of employees working at the mill during its heyday.

Located in a severely distressed area designated as a Appalachian Regional Commission Distressed Area, the mill would only remain vacant for a couple of years until it was purchased in 2017 by a joint venture between Taft Family Ventures of Greenville, NC and Belmont Sayre Holdings of Chapel Hill, NC who immediately began planning to redevelop the site, which includes the first commercial phase of a 107,269 square foot warehouse building renovation into a mixed-use building to include non-profit, health and wellness, and retail uses.

The $18.9 million project supports 197 direct jobs with 64% being quality jobs and 58% being accessible jobs to people with a high school diploma or less in an area that exhibits poverty of 44.2% and an unemployment rate of 11.3%. The project sponsor also committed to offering space to non-profit and locally owned tenants of at least 20% below market and at closing the average percent below market was 51.48%.

Feed & Seed, a local non-profit with a mission to increase food security for all South Carolinians, will occupy over 18,000 square feet of space, providing them a permanent home for the first time in an HFFI designated food desert. The YMCA of Greenville will operate an almost 13,000 square foot fitness center, providing the neighborhood with its only wellness facility open to the public. Tenants of the project have committed to providing reduced rates for low-income residents, free demonstration and training programs for area residents, and community gardens and produce stands at below market rates.

Financing

The Innovate Fund allocated $16.5 million in NMTCs to the project, making it The Innovate Fund’s single largest investment. Truist Community Capital provided the NMTC equity and source loans were provided by Reinvestment Fund and CommunityWorks, both certified Community Development Financial Institutions. In addition to New Markets Tax Credits, the project also utilized federal and state Historic Tax Credits and state Textile Revitalization Credits.

For more info, contact Tammy C. Propst | 864.271.2737 | tammy.propst@cbh.com